how to change how much taxes are taken out of paycheck

Increase the number on line 4 b. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

How To Make Sense Of Your Pay Stub

Now you claim dependents on the.

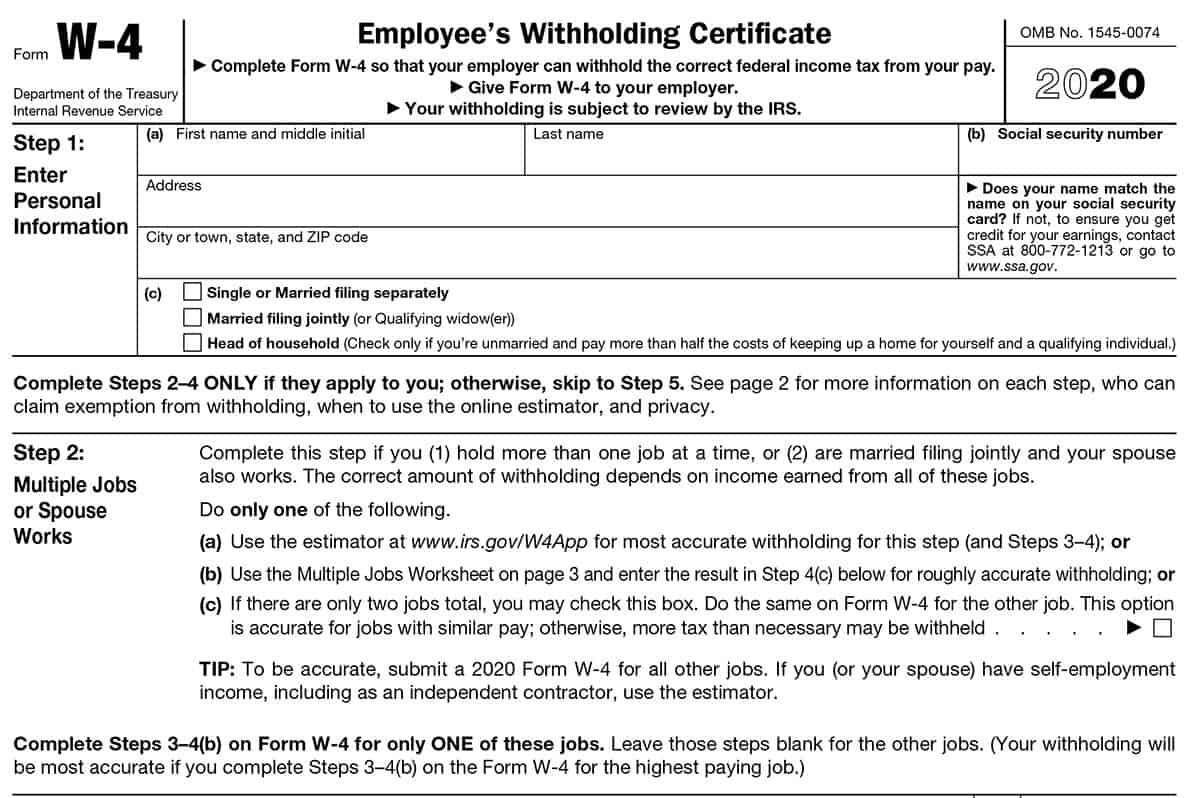

. For example if your records show that the employee was. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. If you simply want to increase your deduction a simple way is to specify an additional amount that you would like to see withheld on your paycheque on line 4 c of Form W-4.

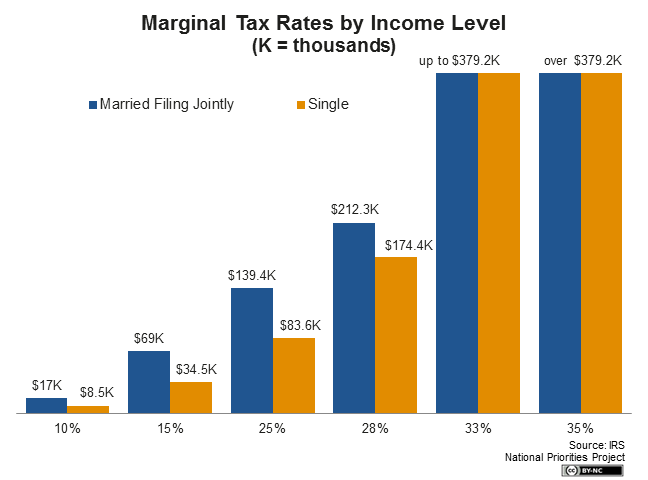

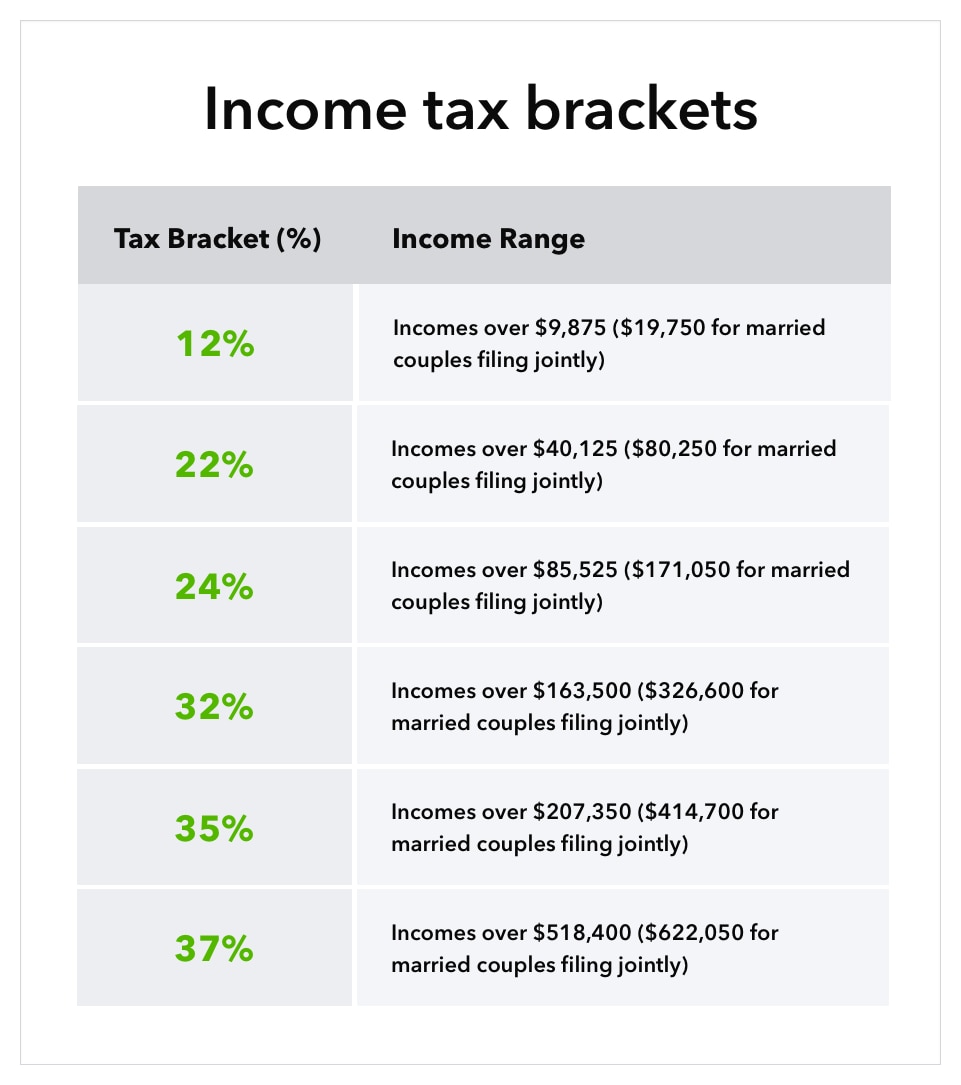

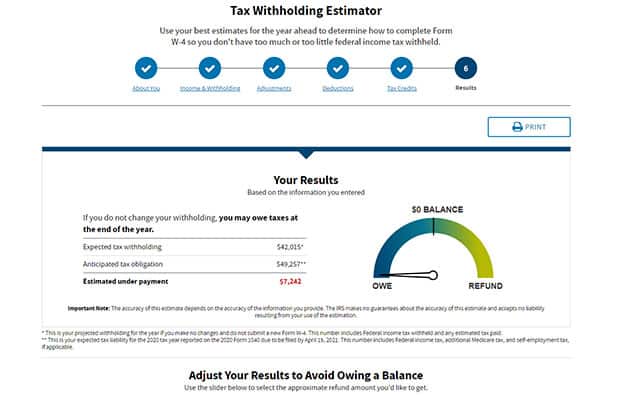

Use the Tax Withholding Estimator on IRSgov. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Federal income taxes are paid in tiers.

Next add in how much federal income tax has already been. How To Adjust Your Withholding To adjust your withholding is a pretty simple process. How do you calculate hourly rate from paycheck.

These are contributions that you make before any taxes are withheld from your paycheck. For instance if you have 100000 of income the marginal tax rate is 24. For the employee above with 1500 in weekly pay the.

That changed in 2020. How can I change. Reduce the number on line 4 a or 4 c.

Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4. For a single filer the first 9875 you earn is taxed at 10. Divide Gross Pay by Hours Divide the gross pay by the wage hours worked.

You need to submit a new W-4 to your employer giving the new amounts to be withheld. Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. But you pay a 22 rate on every dollar under 89076 12 on every dollar less than 41776 and so on.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. How to have less tax taken out of your paycheck Increase the number of dependents. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new.

Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. Complete a new Form W-4P Withholding Certificate for Pension or Annuity.

Peach State residents who make more money can. Overview Of Georgia Taxes. This is a rough estimate of what your.

Set Up Your Paycheck Quicken Help Site

Irs Form W 4 Bigger Paycheck And Lower Taxes Youtube

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Payroll Taxes Tips For Small Business Owners Article

How Many Tax Allowances Should I Claim Community Tax

How Much Federal Tax Is Taken Out If You Claim 8 Deductions

W4 Form Tax Withholding For Irs And State Income Taxes

State Withholding Form H R Block

Alabama Paycheck Calculator Smartasset

Tax Withholding Changes Can Boost Your Paycheck Kiplinger

How To Fill Out Form W 4 W4 Withholding Allowances Taxact

Paycheck Taxes Federal State Local Withholding H R Block

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

9 Steps To Adjust Your Tax Withholdings For A Larger Paycheck Finder

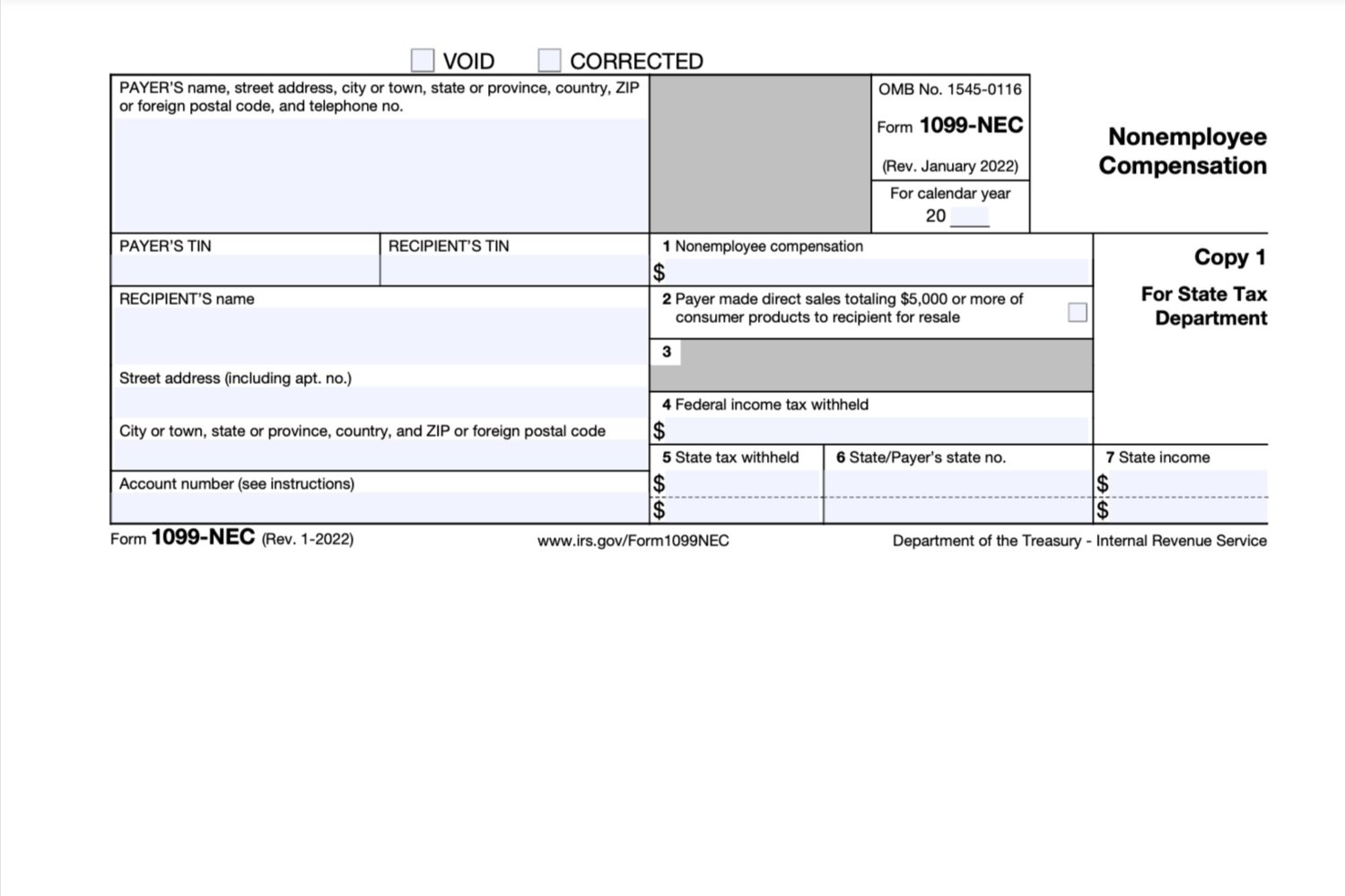

Doordash 1099 Taxes And Write Offs Stride Blog

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding